Financial leverage is a measure of the relationship between the EBIT and the EPS. TheDFL reflects the effect of change in EBIT on the level of EPS. It is defined as % change in EPS divided by the % change in EBIT.

Expansion of the firm takes place by issuance of debt securities. Interest expense and taxes are included in the calculation. The use of excessive debt threatens the solvency of the company. Capital structure reflects the overall strategy of the firm. Capital Structure – CS Executive Financial and Strategic Management MCQQuestions with Answers you can quickly revise the concepts. If sales rise by 1 % at the firm, then EBIT will rise by 3.5%.

Send money abroad in just a few taps.

It’s no surprise that another Adani group company is in the list of high leverage companies. Let us take a look at high leverage stocks from the BSE 500 index. Premium While companies with high leverage are tempting bets because they trade at high betas, the flipside is that they also fall further when share prices drop.

- Financial leverage is therefore a double-edged sword as it has the advantage of reducing your cost of capital but also enhances your bankruptcy risk.

- Thus, firms with excessive debt-to-equity ratios could not be able to attract additional capital.

- It is quite useful in analyzing the degree of financial risk a company is exposed to and in predicting possible financial distress.

- Do you have the nerves of steel or do you get insomniac over your investments?

- However, usage of excess leverage to push up the ROE can turn out to be detrimental to the health of the company.

Calculate the Return-on-equity for the company and indicate its segments due to the presence of Preference Share Capital and Borrowing . Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Money that the borrowing entity owes or is required to pay to a lender. Define the term leverage and explain its classification. Invest in stocks with Free Expert Advice only with MO INVESTOR.

Investors can normally afford to assume larger risks in the ____ phase of the life- cycle.

The tendency of sales to vary disproportionately with the fixed cost. When sequential long-term financing is involved, the choice of debt or equity influences the future financialof the firm. Positive as equityholders face a lower effective tax rate. Levered firms pay less taxes compared with identical unlevered firms. Equivalence value between levered and unlevered firms in the presence of taxes. Managers can make correct corporate decisions that will satisfy all shareholders if they select projects that maximize value.

What does low financial leverage mean?

If a company's financial leverage ratio is excessive, it means they're allocating most of its cash flow to paying off debts and is more prone to defaulting on loans. A lower financial leverage ratio is usually a mark of a financially responsible business with a steady revenue stream.

Have a high proportion of equity and considerably a very low proportion of debt. Have a high proportion of debts and considerably a very low proportion of equity. Increases the profit after tax even though sales pattern shows decreasing trends. Affects equity share values and in unfavourable situation equity share prices may consequently drop. According to Cost Principle an ideal pattern or capital structure is one that -………….. Expansion of the firm takes place by issuance of short term and marketable securities.

As stated previously, the degree of combined leverage may be calculated by multiplying the degree of operating leverage by the degree of financial leverage. Operating leverage is a cost-accounting formula that measures the degree to which a firm or project can increase operating income by increasing revenue. A firm’s degree of total leverage is equal to its degree of operating leverage its degree of financial leverage . This ratio depicts the efficiency of the company is using its assets.

Stocks With High Financial Leverage

10 bn to manufacture electric vehicles under a separate vertical. They believe companies will be able to make repayments accordingly. Started in 1996, the company’s flagship brand ‘Club Mahindra’ has over 250,000 members. The strategies adopted by the richest Indian, Mukesh Ambani, and the second richest were a story of contrasts.

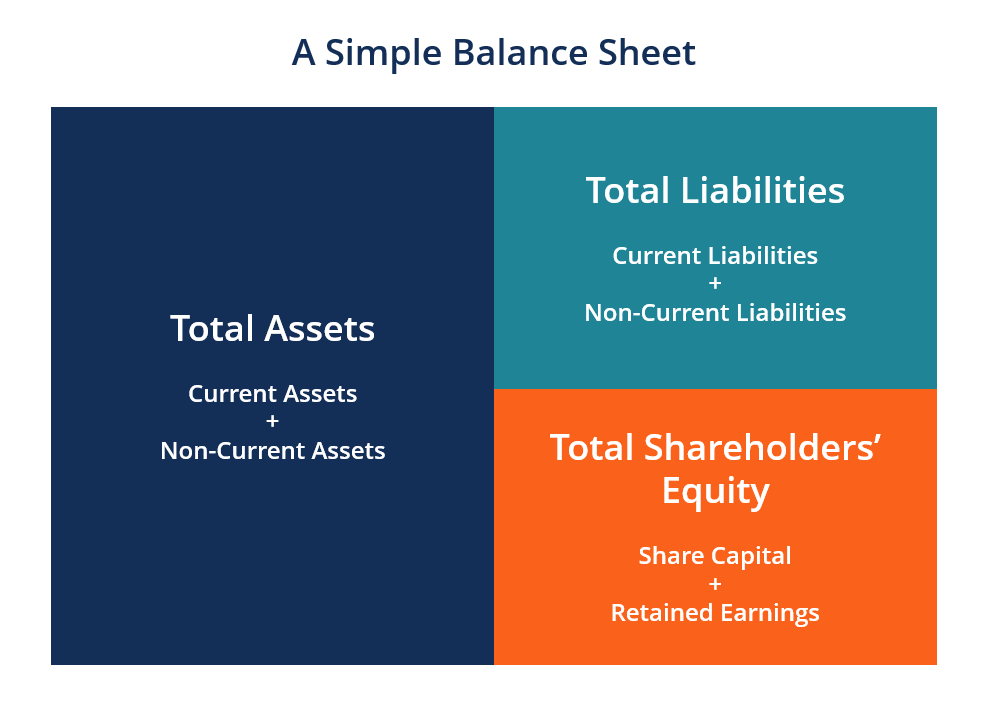

The debt to equity ratio is considered a stability sheet ratio as a result of all the elements are reported on the balance sheet. It’s essential to compare an organization’s gearing ratio to corporations in the identical trade. It revolves around the concept used to evaluate the amount of debt that a company is required to repay.

Internal Sources of Finance

The gearing ratio is are a measure of economic leverage that demonstrates the degree to which a firm’s operations are funded by equity capital versus debt financing. The gearing ratio is a monetary ratio that financial leverage is zero if compares some form of owner’s equity to debt, or funds borrowed by the company. This is as a result of companies that have larger leverage have higher amounts of debt compared to shareholders’ equity.

Financial risk is determined by the debt-equity ratio. Sell some shares of X ltd. and loan it out such that he creates a personal debt-equity ratio equal to that of the firm. By raising the debt-to-equity ratio, the firm can lower its taxes and thereby increase its total value. Well, it is an extended examination of the Return on Equity of a company that analyses Net Profit Margin, Asset Turnover, and Financial Leverage. This analysis was developed by the DuPont Corporation in the year 1920. DuPont analysis is a useful technique of breakin down the different return on equity generators.

From the following data of Abhishek Ltd., compute the operating leverage, financial leverage, combined leverage. If contribution is less than fixed cost, operating leverage will be favorable and vice versa. With the increase in fixed cost operating leverage diminishes. The Analysis is very important for an investor as it answers the question of what is actually causing the ROE to be what it is.

Banks typically have preset restrictions on the maximum debt-to-equity ratio of borrowers for different types of businesses outlined in debt covenants. A high gearing ratio shows a excessive proportion of debt to fairness, whereas a low gearing ratio exhibits the opposite. The basic analysis uses the degree of operating Leverage, which is a measure that indicates the change in a company’s operating income with respect to its change in sales. Companies, which have a large proportion of fixed costs as compared to their variable costs, have a higher level of operating Leverage. Both companies and investors use financial leverages.

In simple terms, leverage may be defined as the % change in one variable divided by the % change in some other variable. Here, the numerator is the dependent variable and the is the independent variable. This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters. You can check about our products and services by visiting our website You can also write to us at , to know more about products and services.

It required rate of return on equity in the absence of borrowing is 18%. In the absence of personal taxes, what is the ‘total value of the company’ and ‘value of equity’ in an MM world with ₹ 70,00,000 in debt. In the absence of personal taxes, what is the ‘total value of the company’ and ‘value of equity’ in an MM world with ₹ 40,00,000 in debt. The firms cost of debt is 10% and currently firm employs ₹ 15,00,000 of debt.

Maximizes cost of capital and minimizes the owners return. QPR Ltd. has high business risk & financial risk as compared to ABC Ltd. If the Return on Investment exceeds the rate of interest on debt, it is financial leverage.

4) No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. To know what’s moving the Indian stock markets today, check out the most recent share market updates here. Debt-free companies don’t have to worry much about a slowing economy or an increase in interest rates. Its subsidiary, ONGC Mangalore Petrochemicals , has high debt levels .

This risk becomes more pronounced when the market is going through a downturn as you have less of operating profits to service your higher leverage. Financial leverage is therefore a double-edged sword as it has the advantage of reducing your cost of capital but also enhances your bankruptcy risk. It is this balance that is the key to your capital mix.

What is zero-leverage firms?

1. Firms with zero short- and long-term debt in a given year. Learn more in: Zero-Leverage in European Firms: The Role of Corporate Governance Mechanisms on the Phenomenon. Find more terms and definitions using our Dictionary Search.

With a debt to fairness ratio of 1.2, investing is much less risky for the lenders as a result of the business is not highly leveraged or primarily financed with debt. However, the best debt to fairness ratio will range depending on the trade because some industries use extra debt financing than others. Capital-intensive industries just like the financial and manufacturing industries typically have greater ratios that can be greater than 2. The debt to equity ratio is a simple formula to indicate how capital has been raised to run a business. It’s considered an important monetary metric because it indicates the steadiness of an organization and its capability to lift further capital to grow. The operating leverage of 1 denotes that the EBIT level increase or decreases in direct proportion to the increase or decrease in sales level.

What is financial leverage formula?

Financial leverage tells us how much the company depends on borrowing and how it generates revenue from its debt or borrowing. Calculating this is a simple total debt to shareholders equity ratio. Financial Leverage Formula = Total Debt / Shareholder's Equity.